How to Register for JTB TIN Online 2025: Complete Step-by-Step Guide

In today’s digital age, everything is moving online including Nigeria’s tax registration system. If you live in Nigeria or operate a business, one of the most important requirements is a Tax Identification Number (TIN). Thankfully, the Joint Tax Board (JTB) has made it possible to apply for your TIN digitally without visiting any office. In 2025, the entire process can be done within minutes on the official portal tin.jtb.gov.ng.

This comprehensive guide will take you through everything you need to know about registering for your JTB TIN online in 2025. We will cover the requirements, the step-by-step process, benefits, and why every Nigerian individual and business must complete this registration. By the end, you will have all the knowledge needed to generate and download your TIN certificate from the comfort of your home or office.

What is JTB TIN?

The Joint Tax Board (JTB) is the federal body in Nigeria that coordinates and harmonizes the administration of personal income tax across the country. The Tax Identification Number (TIN) is a unique 10-digit number issued to individuals and businesses. It is used by the Federal Inland Revenue Service (FIRS), State Internal Revenue Services (SIRS), and other financial institutions to track tax compliance and financial transactions.

Unlike in the past when one had to physically visit tax offices, the JTB introduced an online system to simplify the process. As of 2025, the platform tin.jtb.gov.ng has been fully upgraded to make TIN registration seamless for Nigerians at home and abroad.

Why You Need a JTB TIN in 2025

Obtaining a TIN is more than a government requirement—it unlocks financial, legal, and business opportunities. Here are reasons why having a TIN in 2025 is non-negotiable:

- Opening bank accounts: Commercial banks in Nigeria now request a TIN for corporate accounts and in some cases for personal accounts.

- Business registration: To complete incorporation with the Corporate Affairs Commission (CAC), a TIN is required.

- Access to loans and grants: Financial institutions and government programs ask for TIN details during application.

- Government contracts: No contractor can apply for federal or state government tenders without a valid TIN certificate.

- Tax compliance: Individuals and businesses must have a TIN to meet statutory obligations under the Nigerian tax system.

- International trade: For businesses engaged in importation and exportation, TIN is mandatory for customs clearance.

Requirements for JTB TIN Registration in 2025

For Individuals

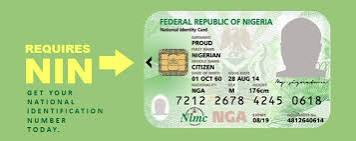

- Full name as registered with NIN (National Identification Number).

- NIN details (mandatory for all citizens).

- Valid phone number and active email address.

- Date of birth and residential address.

For Businesses

- Business name or company name registered with CAC.

- RC or BN Number from CAC registration.

- Company address and official email.

- Director(s) information (NIN, phone numbers, emails).

Without these documents, you will not be able to successfully register for your JTB TIN in 2025.

How to Register for JTB TIN Online in 2025

The process of obtaining your TIN online in 2025 is simple and fast. Here’s the step-by-step procedure:

Step 1: Visit the Official Portal

Go to the official Joint Tax Board TIN portal: https://tin.jtb.gov.ng. Ensure that you are on the correct website to avoid scams or fake portals.

Step 2: Select Registration Type

You will be presented with two options:

- Individual TIN Registration: For personal use.

- Business/Corporate TIN Registration: For registered companies or business names.

Step 3: Fill Out the Online Form

Provide accurate details including your NIN (for individuals) or CAC number (for businesses), alongside phone number, email, and address information. Double-check for errors before submitting.

Step 4: Verification of Information

The portal automatically verifies your information:

- For individuals, details are cross-checked with the NIMC database.

- For businesses, information is verified with CAC.

Step 5: Generate Your TIN

Once verification is successful, your unique 10-digit TIN will be generated instantly.

Step 6: Download Your TIN Certificate

You can download and print your TIN certificate directly from the JTB portal. This certificate will be required for tax filing, banking, and other official purposes.

How to Verify Your JTB TIN in 2025

If you already have a TIN but want to confirm its authenticity, you can use the verification portal at tinverification.jtb.gov.ng. Simply enter your TIN or NIN/CAC number to confirm validity.

Benefits of Online JTB TIN Registration

There are numerous benefits of registering online in 2025:

- Speed: Registration takes less than 10 minutes.

- Convenience: No need to queue at FIRS or SIRS offices.

- Free of charge: The process is entirely free.

- Nationwide acceptance: The TIN works across all states in Nigeria.

- Legal compliance: Ensures you are recognized by Nigerian tax authorities.

Challenges Nigerians Face with TIN Registration

Although the process is now online, some Nigerians still face challenges:

- Internet issues: Poor connectivity in some areas may affect registration.

- Incorrect data: Errors in NIN or CAC details may lead to rejection.

- Technical downtime: Sometimes the JTB portal experiences downtime due to high traffic.

- Lack of awareness: Many citizens do not know they can register online for free.

To overcome these challenges, always ensure your details match official records, use stable internet, and check back during low-traffic hours if the portal is slow.

Conclusion

Registering for your JTB TIN online in 2025 is no longer complicated. With the upgraded tin.jtb.gov.ng portal, individuals and businesses can complete the entire process in minutes. From opening bank accounts to applying for government contracts, a TIN is now indispensable in Nigeria’s financial and tax systems.

If you haven’t registered yet, don’t delay—visit tin.jtb.gov.ng today and secure your TIN certificate. It is fast, free, and legally required. By doing so, you align yourself with national tax laws and open up countless opportunities for your personal and business growth.